If you can’t do it right, it’s not the right time to do it.

That handy phrase is ideal for assessing the timing of big moves like buying a home or car, or even investing, but it doesn’t quite work when it comes to timing one’s move out of the military.

Sure, in many cases, you can choose when you will shift to the civilian world, but in the current “force-shaping” environment, your departure may be something that happens to you, regardless of your wishes.

So, it could be difficult — if not impossible — to get your timing right on this particular move. However, it still makes sense to do the necessary research, make plans and be as ready as you can for the eventuality.

Here are five financial steps that may help you get the timing right, even if you’re not at the controls:

Build Your Transition Fund

Cash may not cure all ills, but it can go a long way toward smoothing your move to civilian life (or your next PCS or unexpected catastrophe). Ideally, you should build up the equivalent at least six months of expenses in a savings account before your transition, but that won’t happen overnight. Even if you see yourself wearing a uniform for years to come, start your transition fund today.

Make A New Budget

This may be difficult without a better idea of where you’re going to live and what you’ll be doing, but you will have vastly different budget inputs when you leave the military. Gone will be tax-free housing and subsistence allowances. You also could see substantially bigger outlays on other items like health insurance.

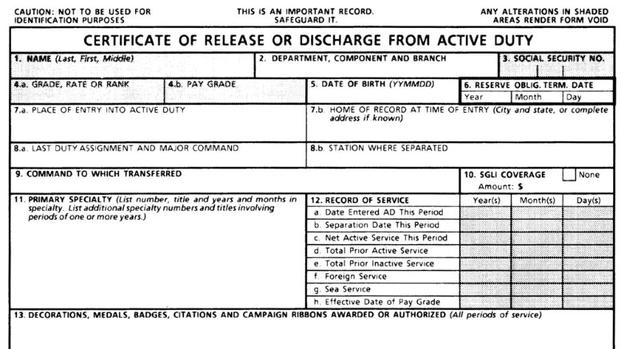

Transition Your Benefits

You’ll want a continuity plan for health care, life insurance and retirement when you change careers. Start reading up on transitional health care options and Veterans Affairs offerings, and consider the advantages of continued service in the Guard or Reserve. Lay the groundwork today, so you don’t get caught short when the time is right.

Plan Education Benefits

While I’m fan of using Post-9/11 GI Bill benefits to put yourself or your spouse in a better place, thus helping your whole family, you may want to transfer benefits to your kids. If that’s your plan, apply for the transfer to all potential beneficiaries now. Remember, while you can revoke or change the allocation, you can’t add names after you separate. Do it now, because there’s a four-year service commitment after the transfer is approved. I’ve already had several conversations with folks lamenting the fact they didn’t act sooner.

Lighten Your Debt For More Flexibility

If you’re weighed down by debt, meet with a financial readiness counselor and implement a strategy to put it behind you. You’ll have a lot fewer worries making the leap without debt holding you down.

While you may not have the power to decide exactly when you’ll leave the military, you can start making the necessary preparations now for whenever it happens.