This time of year, I hear lots of military families who are excited about big income tax refund: $2000, $3000, and up. I understand why it is exciting to receive a big chunk of money like that, and it isn't always a bad thing. There are a ton of smart uses for a large income tax return: paying off debt, building up an emergency fund, putting it into a new car account, etc.

This time of year, I hear lots of military families who are excited about big income tax refund: $2000, $3000, and up. I understand why it is exciting to receive a big chunk of money like that, and it isn't always a bad thing. There are a ton of smart uses for a large income tax return: paying off debt, building up an emergency fund, putting it into a new car account, etc.

The part that bothers me about these big tax refunds is that a lot of people don't understand why they are getting so much money refunded or given to them. There are two reasons why you would get a tax return: you are having too much money withheld over the course of the year, or you are receiving large, refundable tax credits such as the earned income credit.

Overwithholding

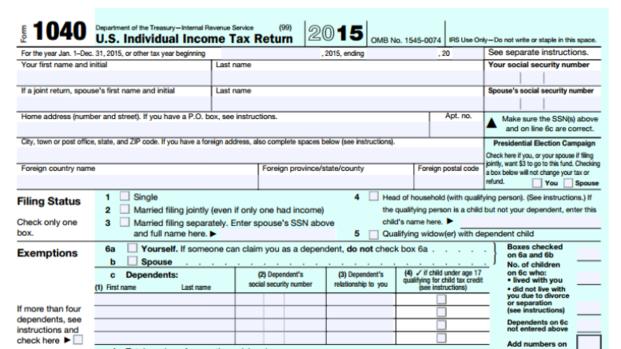

Our tax system works on a withholding system. Instead of asking tax-payers to pay their entire tax bill at the end of the year, employers collect a little bit with each paycheck, based upon the instructions that the employee has provided in their W-4 Employee's Withholding Allowance Certificate. At the end of the year, the taxpayer calculates their actual tax bill on their income tax return, and compares it to how much they've had withheld during the year. Haven't withheld enough? You'll have a balance to pay. Withheld too much? You'll get a refund.

When your refund is the result of overwithholding, that means you are having too much deducted from your paycheck each month. Adjusting your withholding would allow you to have a larger take-home paycheck instead of a big refund at the end of the year.

Getting withholding right can be tricky, particularly with the ups and downs of military pays, and the life changes that are associated with frequent Permanent Change of Station (PCS) moves. It's also hard because the W-4 form uses the most basic information to guesstimate what your withholding should be. If your situation is anything beyond simple, then using the W-4 worksheet probably isn't going to give you the optimal withholding amount.

What can you do? There are a couple of things. First, if you are always receiving large tax refunds, you can change your withholding. In many cases, withholding is incorrect because it hasn't been updated to reflect changes to family size, such as a marriage or a new baby. Even if all your details are correct, you can opt for withholding an amount different than what the worksheet tells you to withhold.

Guesstimating how much to change can be tricky, so I'd start small. Changes to your federal W-4 can be made directly into the MyPay online account access system. Even just changing your deductions by 1 will push you closer to a balance at the end of the tax year.

If you'd like to be a little bit more accurate, you can take the prior year's tax return, adjust for any expected changes (such as raises or a mortgage interest deduction on a new mortgage,) and see how your expected tax bill compares to how much you're currently having withheld.

My super-analytical friends take this process a step further, checking every few months to see how their withholding for the year is comparing with their estimated tax liability for the year. Because it is very easy to change your withholding in the MyPay system, they can tweak their withholding as the year progresses. I have one amazing friend who was able to get his withholding within $50 of his actual tax bill on year. (At least some of that was just luck, but he does an exceptional job of tracking this type of thing.)

You don't have to take the math-heavy route to benefit from more accurate withholding. A small simple step is still a good step.

If this befuddles you, you can check with a financial counselor at your family support center (Fleet and Family Service Center, Airman and Family Readiness Center, Marine Corps Community Services, or Army Community Services) or see if your base Volunteer Income Tax Assistance (VITA) program can give you a hand.

Refundable Income Tax Credits

Not all large refunds come from overwithholding. Some military members, particularly those with children and/or who are in a Combat Zone Tax Exempt (CZTE) area, may be eligible for the Earned Income Tax Credit (EITC). The EITC is a variable amount of money given to taxpayers as an incentive to work. Because it is "refundable," the EITC may result in the government paying you at tax time, even if you pay no taxes.

It is important to understand why you are receiving a large refund or payment at tax time. If appropriate, withholding changes may be able to put more of that money in your pocket throughout the year instead of getting a big chunk at once. While neither way is "right," getting a big refund may mean that you've been giving the government an interest-free loan during the year. If that doesn't appeal to you, you can change it!

Getting withholding right is a small act that can pay off all year long. It will only take you a few minutes to adjust your tax withholding and you'll have the benefit all year long. Do it today!