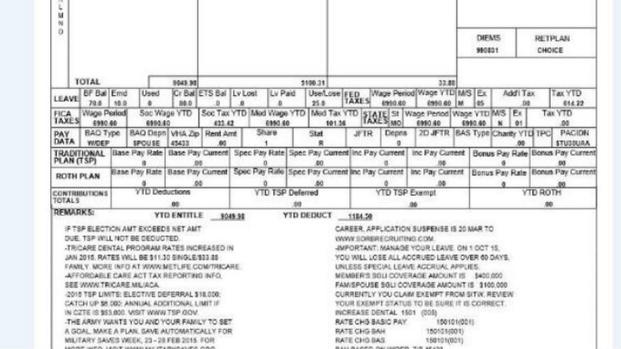

It has come to my attention that a glitch in the Leave and Earnings Statement (LES) system may mean that your Year-to-Date (YTD) Roth Thrift Savings Plan contributions are probably wrong, if you made any Roth contributions in January 2015.

If you remember back to January, you may recollect that there was a change to the system by which you instructed the Defense Finance and Accounting Service (DFAS) to withhold Roth TSP contributions. Previously, you designated Roth TSP contributions as a set dollar amount, and that amount was shown in the Allotments section of the LES. (No good explanation for the Allotments thing, but that was the system.) Last January, everyone had to re-designate their Roth TSP contributions, using a percentage of pay system, and now those contributions show up in the Deductions section of the LES.

Ever since that switch, the YTD contributions block of the LES have not been reflecting any Roth amounts that were made in January 2015. I first heard of this situation today, when a reader noticed that his YTD contributions did not equal the amount that he had planned to contribute. It took a little sleuthing, digging up old LES, and some math, but it seems that he had contributed the correct amount, but the LES was wrong. The service member had contributed the amount that he planned, but the YTD block didn't show the entire amount because it didn't include contributions from January.

There's good news and bad news in this revelation: Good news, because it seems that the intended amount has been taken out all along. Bad news, because many service members (including my husband) calculated their contributions assuming that that YTD block was correct. Good news, because any miscalculations that resulted from using the YTD information resulted in the service member contributing more than they planned, not less.

I'm going to assume that the error occurred because of the change to the Roth TSP contribution election system, and it won't happen again going forward. However, I will definitely be keeping a closer eye on the totals in the future. I'm a little embarrassed that I didn't notice it earlier, and I won't make that mistake again.

Does your LES have this error? Did you notice it earlier in the year? Just curious...