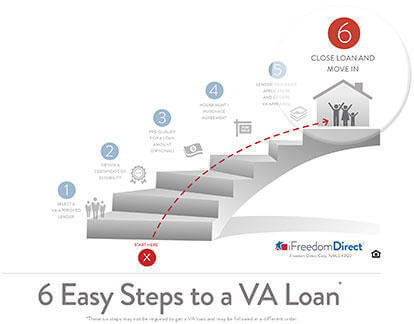

If you take the six steps to a VA home loan one at a time, you may find that the home buying process is easier than you thought. Learn the DOS and DON’TS of the sixth step: Closing on your VA loan and Moving In.

If your VA loan application has been approved and processed, all that’s left to do is close and move in. Closing is an important final step in the process as it allows you to confirm with your signature that you agree to the terms of your loan.

Most closings take place at a title company or attorney’s office and are led by a closing agent. The buyer and the seller usually attend their portions of closing separately. Others attending may include a person from the title company, your real estate agent and your lender. Both the buyer and seller may also have legal representation at closing. Each person has an important part, and at the end of closing the property belongs to you. You can then move in and make yourself at home.

To prepare for this exciting and final step, here are a some “Dos” and “Don’ts” to consider for closing:

1. DO take the time to read what you are signing.

The paperwork you’ll see at closing are all the legal documents having to do with your loan and the legal transfer of the home. Signing closing documents can seem like just a formality. However, it’s very important that you read your documents thoroughly. It’s typical for your closing agent to provide you with a verbal summary of each page as you sign, but you should still pay attention to what the document says to make sure everything is accurate. Though all of the information should be of no surprise, for most buyers, this is the first time they will see all the details of the loan and deed in one place. You could ask for an advance copy, so you can review and familiarize yourself with each document before closing. And you could bring an attorney to go over the documents.

2. DO keep your eye on the prize — YOUR NEW HOUSE.

Remember that shortly after you close on your VA loan, you can move into your new house. Keeping that vision in mind can give purpose to the whole loan process. All that time spent gathering documents and proving your ability to qualify is now behind you. You’re about to become a homeowner, and that should feel pretty sweet! Take a deep breath and enjoy the moment.

3. DO bring the right amount of cash for closing costs.

Before your closing date, a tally of your costs should have been conveyed to you. Your loan officer is usually the one to inform you of the amount and instruct you on the forms of payments accepted at closing. Costs can include things like the appraisal fee, pre-paid taxes and insurance and other expenses for escrow, title fees, delivery charges and any closing costs not paid by the seller. Even though 89 percent of VA purchases are made without a down payment, many borrowers end up paying at least a few fees or expenses at closing.

4. DON’T panic if you see two rates on your closing documents.

Often, one of the most confusing parts about a home loan has to do with the two rates listed on the closing documents: the mortgage interest rate and the annual percentage rate (APR). Your loan officer will likely have already explained the differences between APR and interest rates before you locked in your rate. But sometimes it doesn’t sink in until you see the two rates side-by-side in the closing documents. Your payments are calculated using your mortgage interest rate. The APR, on the other hand, also takes into account the fees you are paying to obtain the loan. It’s a government mandated term to show the cost of your credit, considering other charges. Higher fees and costs generally mean a larger spread between the two rates. Your closing agent should go over the two rates one more time before you sign.

5. DON’T hesitate to ask questions if you don’t understand something.

The whole point of closing is to make sure you understand the terms of the loan you are about to commit to pay and the purchase of the home. If there is something you don’t understand, by all means ask. Most borrowers want a final explanation of their rate and fees even if they understand it going into the closing. Another issue that is often confusing is escrow. Prior to closing, your loan officer will tell you how much cash you’ll need for pre-paid taxes, insurance and other escrowed items, and will explain that it is kept in escrow and paid later when due. The professionals who are present at the closing table are there to support you in this final step of the process, which includes answering your questions.

6. DON’T forget your keys and get ready to move in!

After your loan is closed, you’ll be given the keys to your new home. Moving day is coming. Remember, with your VA purchase loan, you verified intent to occupy the home as a primary residence within a reasonable time. For most VA borrowers, that’s 60 days, unless the service member is on active duty. Make good on that promise and take pride in homeownership. You earned it!

Ready to Shop for a New Home?

The first step in the VA loan process is to shop around for a lender. We make the process easy by matching you with up to five lenders for rate quotes - no obligations or credit checks required.