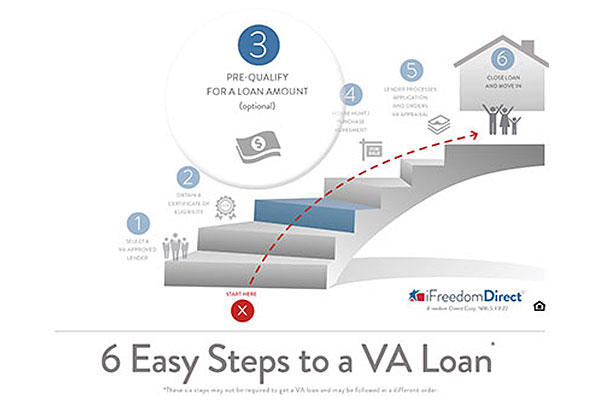

Following 6 easy steps to a VA home loan can help make the process go more smoothly. Learn the DO’S and DON’TS of the optional third step: Prequalifying.

VA Loan Prequalifying is one of the first steps a borrower may choose to take after they have connected with a VA-approved lender. Prequalification is an initial assessment of the borrower’s ability to qualify for a loan based on preliminary information about income, debt and credit. Prequalifying typically occurs before formal documents are received and reviewed by the underwriter, so it does not guarantee loan approval.

Since VA loan prequalification is not the same as approval, what is the value of this optional step? First, prequalifying can give you a ballpark price range for house hunting. What’s more, it can help your loan officer get an early look at your credit and income and spot potential issues that might delay your loan. Often, these issues are minor and can be resolved by paying off an old debt or calling a creditor to clear up an error. If you opt to prequalify, you can often prevent surprises later when you complete your formal loan application.

To help you get the most out of the prequalification process, here are some “dos” and “don’ts to follow for VA loan prequalifying:

1. DO tell your loan officer everything.

You’d be surprised at all the information a loan officer needs to get your application started. Questions like “Are you divorced?” and “Do you get child support?” may seem a little bit personal at this early stage in your relationship. However, anything and everything that has to do with your income, debt and credit will need to be on the table. Leaving bits of information out of the initial conversation with your loan officer may create problems later. Be candid from the onset so your loan officer has the ability to help you achieve success.

Still looking for the right lender? Click here to connect to one of our VA loan professionals.

2. DO ask questions.

If you think something in your financial portfolio or personal life might be relevant to qualifying for a loan, ask about it. Maybe you have rental income or tips from a second job. You might have a large stash of cash in a retirement account or another asset that isn’t obvious to your loan officer at first. Additional assets can help get you approved, especially if you are on a fixed income, so be sure to bring them up if you choose to take this step.

3. DO understand that prequalifying is not the same as approval.

If your loan officer tells you that you’re prequalified, it doesn’t mean you’re automatically approved for a loan. You’ll still have to prove, through documentation, that you qualify. If you can back up all the income, debt and credit information you gave for this step, and there are no other qualifying problems that come up, then chances are good that the underwriter will stamp “Approved” on your VA loan application. Prequalification is like the shotgun at the beginning of a race. You have been given the signal to proceed, but your application must be approved to cross the finish line.

4. DON’T keep secrets.

An important part of a loan officer’s job is to probe for more information. The best thing to do is be completely honest about your financial affairs. If something comes up that could prevent approval, a good loan officer will be able to guide you in a direction that can help you get approved later. “Think of prequalifying as a pop quiz before the final test,” says Retired Major Tim Lewis, 23-year Army veteran and customer experience manager for iFreedom Direct®. “If you get something wrong, you can get help with the subject so you can get it right when it really counts.”

5. DON’T panic.

This step is a first glance at your credentials for a loan. Use this step to gain information about what you need to get approved. Worrying about a borderline credit score or an old bankruptcy isn’t going to help you or your loan officer. Instead, when you hit road bumps along the way, take a few deep breaths and then begin planning. It may take a little time, but commit to working diligently with your loan officer to fix issues that could be a roadblock to homeownership.

6. DON’T apply for new credit after you’ve been prequalified.

In all the excitement of the home buying process, some borrowers forget that the loan is not complete until closing day. Now is NOT the time to get a new car or another credit card. New credit lines and loans will change your debt-to-income ratio and could affect your approval status. Wait until after your VA mortgage has closed to buy that new living room set or big screen TV.

Take the Next Step

If you’ve earned home loan benefits, prequalifying can get you one step closer to becoming a homeowner. Click here to get started with a VA-approved lender that specializes in government-backed home loans for the military community.